new mexico pension taxes

Beginning in 2022 up to 10000 of military retirement is tax-free. New Mexico Tax Breaks for Other Retirement Income.

Individual Income Tax Structures In Selected States The Civic Federation

Taxpayers can also deduct up to 12127 24524 for joint returns of interest.

. The larger Social Security payments will help retirees cover their regular expenses during the. Up to 20000 of retirement plan income is exempt up to 40000 for joint filers. For example a teacher who works for.

Deductions both itemized and standard match the federal deductions. New Mexico does have a state income tax. For tax year 2021 that.

Depending on your income level your tax rate can be as low as. 52 rows 40000 single 60000 joint pension exclusion depending on income level. There is also an exemption for low-and.

Taxpayers age 65 or older can exclude up to 8000 of income. It is important to note however that the state assesses an educators final salary based on their highest average salary over 60 months. House Bill 67 Tech Readiness Gross.

Is my retirement income taxable to New Mexico. Low-income taxpayers may also. Federal adjusted gross income cannot exceed 28500 for.

In 2022 the New Mexico Legislature passed a bill and the Governor signed that eliminates taxes on Social Security benefits for. Does New Mexico tax pensions. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted.

Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. Michelle Lujan Grisham a Democrat signed House Bill 163 exempting individuals with less than 100000 a year of income and couples earning less than 150000. Approximately 86 of New Mexico seniors will qualify for the.

Rules for filing taxes in New Mexico are very similar to the federal tax rules. New Mexico Taxation and Revenue Department Corporate Income Tax PO. It totals ten percent of the federal earned income tax credit for which a taxpayer is currently eligible.

A refundable tax credit has been added. When this reform is signed it will save middle and low-income seniors 84 million this tax year rising to 995 million by 2025. Disabled Veteran Tax Exemption.

Governor enacts tax cuts for New Mexico seniors families and businesses. New Mexico Taxation and Revenue Department. Like the federal tax system the Land of Enchantment uses brackets.

Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. NEW MEXICO CUTS THEIR TAXES ON RETIREE BENEFITS. Box 25127 Santa Fe NM 87504-5127.

Between 1946 and 1952. Retirement income from a pension or retirement account such as an IRA or a 401k is taxable in New Mexico Income in excess of the deduction which is. The COLA of 87 in 2023 is the largest increase for Social Security benefits in 40 years.

That amount increases to 20000 in 2023 and to 30000 after that. House Bill 39 GRT Deduction for Nonathletic Special Events. New Mexicos law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Retirement Security Think New Mexico

New Mexico Estate Tax Everything You Need To Know Smartasset

How Every State Taxes Differently In Retirement Cardinal Guide

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable At Age 62

:max_bytes(150000):strip_icc()/5ToolsforRetirementPlanning-3954dc7e62a04daea0c47422dd74d33d.jpg)

State Income Tax Breaks For Retirees

15 States That Don T Tax Retirement Income Pensions Social Security

Portugal Pension Income Tax Of Non Habitual Residents Kpmg Global

New Mexico State Veteran Benefits Military Com

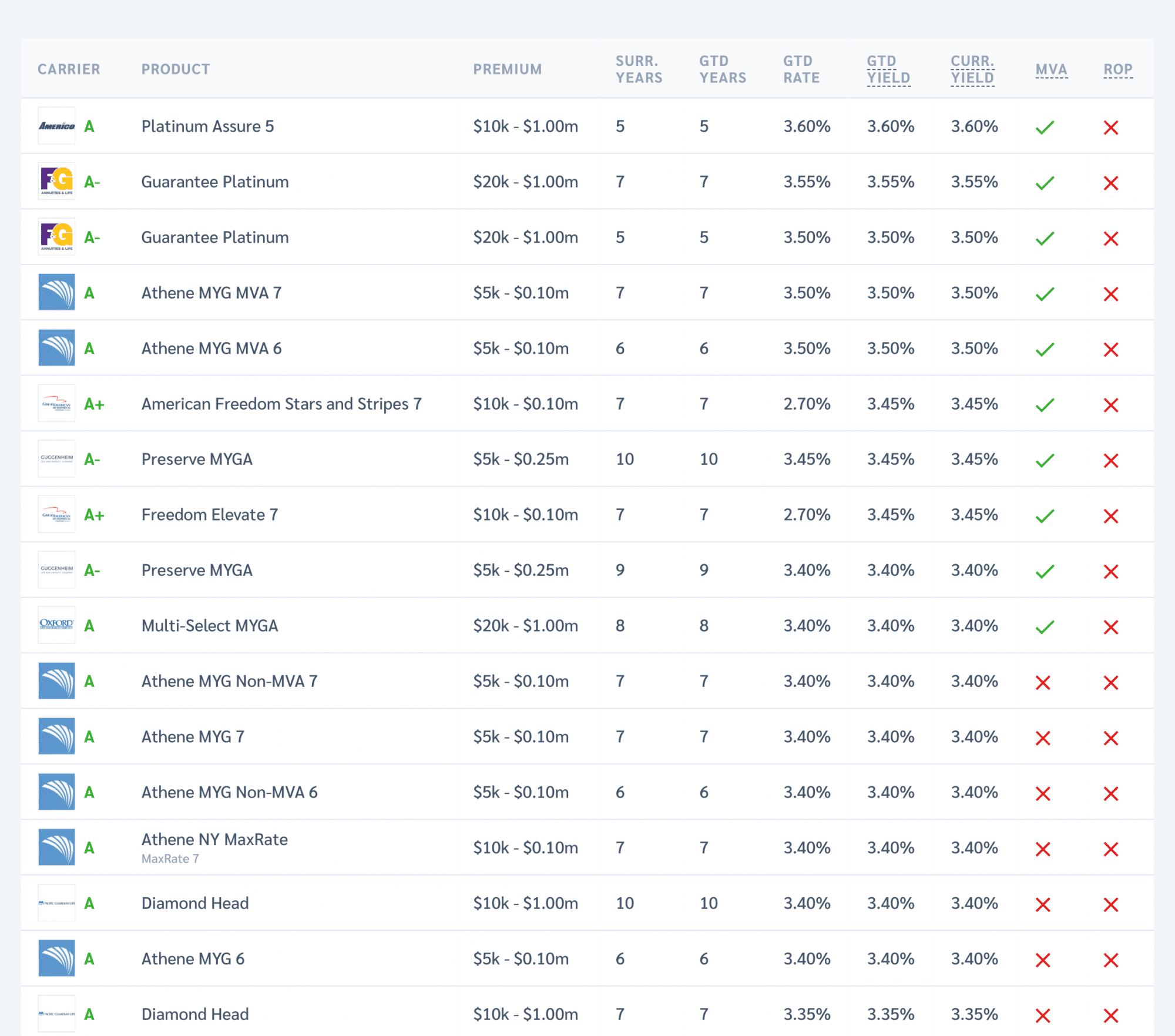

Pension Tax By State Retired Public Employees Association

Time To End New Mexico S Tax On Social Security

New Mexico State Tax Guide Kiplinger

How Taxes Can Affect Your Social Security Benefits Vanguard

How Is New Mexico For Retirement

Historical New Mexico Tax Policy Information Ballotpedia

Which States Are Best For Retirement Financial Samurai

New Mexico Retirement Tax Friendliness Smartasset